Queens’ College Approach to Investments

The College, as a long-term investor, has a medium risk appetite for the management of its investments.

The College assesses all its investments - whether direct, via appointed managers, or indirect (such as pooled funds and ETFs) - against agreed risk parameters and with due regard to environmental, social and governance issues.

The College does not invest directly in any fossil fuels and it endeavours to minimise any indirect investments. The College does, however, hold investments in certain funds, such as clean energy funds, where some of a fund’s underlying investments involve companies in which fossil fuel companies may have minority holdings. The College is only interested in the clean energy investment.

In the last two years, the College has increased significantly its holding of ESG funds. This is part of the shift to investing in key themes for the future, including clean energy, healthcare, automation, and digital intelligence. We believe in rebalancing our portfolio through long-term investing and are committed towards these thematic areas. The College has also committed a part of its investment assets to support venture capital funds investing in technologies and companies which will further the goal of

de-carbonisation over time.

We recognise our investment stance on fossil fuels may have detrimental short-term financial impacts during periods of higher oil and gas prices. Nonetheless, as a long-term perpetual institution we do not feel we should compromise our approach.

The College now undertakes an ESG analysis of its holdings representing a significant and increasing portion of its total portfolio, relying on data provided by Morningstar and Sustainalytics, as a means of tracking the effectiveness of its investment policies regarding ESG and carbon metrics. The information appears in the graphs below. This type of analysis is still evolving, and the College will continue to seek analytical and implementation improvements over time. In due course, it will apply this analysis to all its non-property holdings.

It should be noted the College is a beneficiary of a trust where the holdings are managed by the University as trustee and so the College does not control that investment or the policy applied to it.

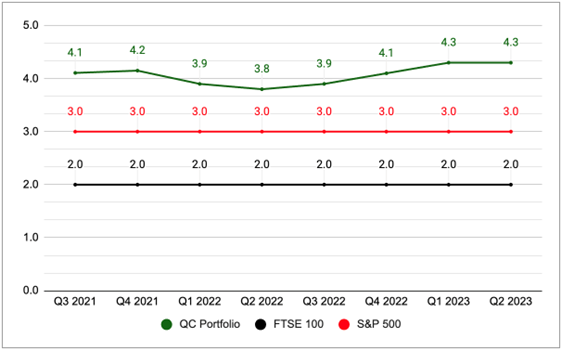

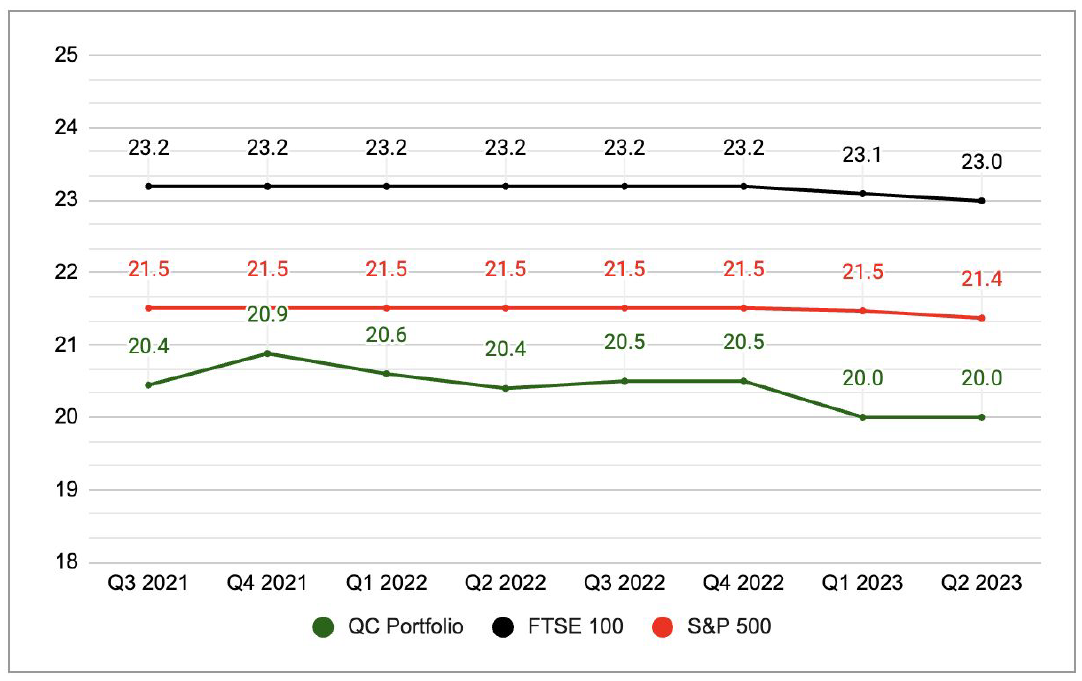

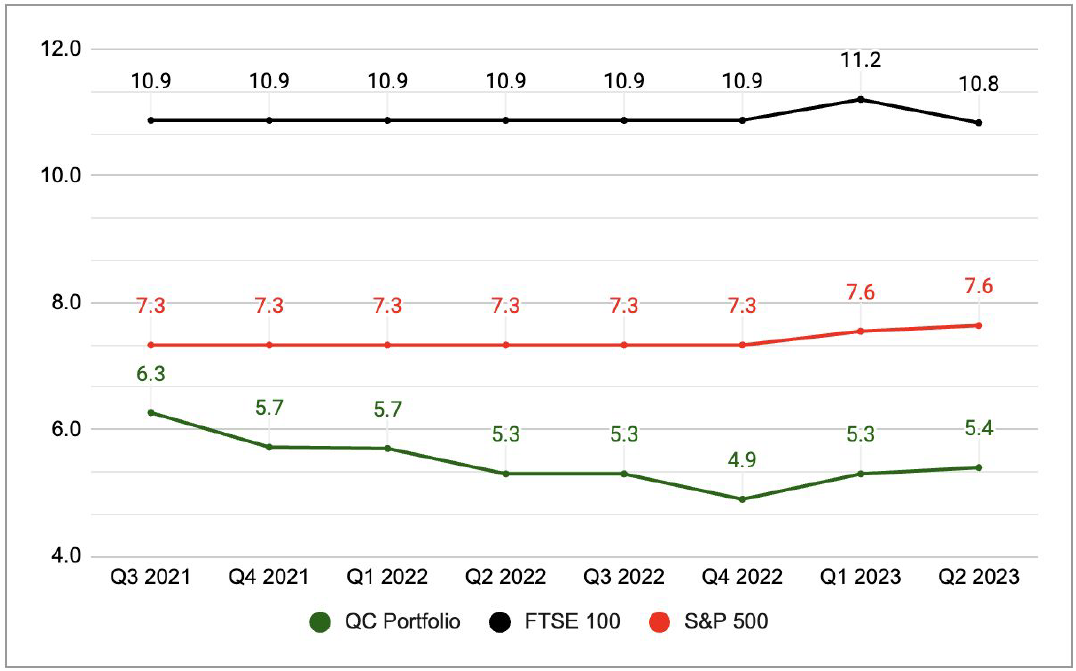

ESG Analysis - Over time

Key Insights:

- For the sustainability score, the changes in scores between quarters are minimal with no strong trend.

- The carbon score shows a nice downward trend (which is a good thing).

Sustainability Score

Sustainability Score

0-9.99 = Negligible ESG Risk

10-19.9 = Low ESG Risk

20-29.99 = Medium ESG Risk

30-39.99 = High ESG Risk

40+ = Severe ESG Risk

Carbon Risk Score

Carbon Risk Score

- Ranges from 0 to 100

- A lower score is better

Sustainability Data

This chart looks at sustainability ratings using the 5 star Morningstar system. A Morningstar sustainability rating takes the value of the sustainability score of a fund and compares that to the sustainability scores of its peer group category (dividing them into 5 groups each representing an incremental 20% percentile).

In this case, a higher value indicates a good score. This is in contrast to the other metrics that have been published in this project (sustainability rating and carbon risk score). This benchmark data is not expected to change significantly over time due to the reduced granularity in the score.